Allocation of income for the authorityyear ended December 31, 2023 | | “FOR” vote of a majority of the Ordinary Shareholders’ Meeting: | 1. | Approval of the annual financial statements for the year ended on December 31, 2020,

votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR | | | | | Allocation of the accumulated deficit to the “Additional paid-in capital” | | “FOR” vote of a majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR |

| 2. | Approval of the consolidated financial statements for the year ended on December 31, 2020,

1

| | | | | Proposals | | Voting Standard | | Board Recommendation |

| Statutory auditors’ special report on regulated agreements and acknowledgement of the absence of new regulated agreements | | “FOR” vote of a majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR | | | | | Renewal of Ms. Adora Ndu, as director | | “FOR” vote of a majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR | | | | | Renewal of Ms. Julie O’Neill, as director | | “FOR” vote of a majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR | | | | | Renewal of Ms. Danièle Guyot-Caparros, as director | | “FOR” vote of a majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR | | | | | Renewal of Mr. Ravi M. Rao, as director | | “FOR” vote of a majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR | | | | | 3. | Allocation of income for the year ended on December 31, 2020,

|

| 4. | Allocation of the accumulated deficit to the “Additional paid-in capital”,

|

| 5. | Statutory auditors’ special report on regulated agreements and acknowledgement of the absence of new regulated agreements,

|

| 6. | Renewal of the term of office of Julie O’Neill as director,

|

| 7. | Renewal of the term of office of Viviane Monges as director,

|

| 8. | Appointment of Ms. Adora Ndu to replace Mr. Torbjorn Bjerke as director,

|

| 9. | Appointment of Mr. Ravi Rao as director,

|

| 10. | Ratification of the provisional appointment of Timothy E. Morris as director,

|

| 11. | Determination of the annual fixed sum to be allocated to the members of the Board of Directors,

|

| 12. | Approval of the compensation policy for the Chairman of the Board of Directors and for the Board members,

|

| 13. | Approval of the compensation policy for the Chief Executive Officer and/or any other executive corporate officer,

|

| 14. | Advisory opinion on the compensation of named executive officers other than the Chief Executive Officer,

|

| 15. | Advisory opinion on the opportunity to consult shareholders each year on the compensation paid by the Company to named executive officers other than the Chief Executive Officer,

|

| 16. | Advisory opinion on the opportunity to consult shareholders every two years on the compensation paid by the Company to named executive officers other than the Chief Executive Officer,

|

| 17. | Advisory opinion on the opportunity to consult shareholders every three years on the compensation paid by the Company to named executive officers other than the Chief Executive Officer,

|

| 18. | Approval of the information set out in section I of Article L.22-10-9 of the French Commercial Code, |

| 19. | Approval of the fixed, variable and non-recurring components of overall compensation and benefits of all types paid or assigned during the year ended to Michel de Rosen, Chairman of the Board of Directors,

|

| 20. | Approval of the fixed, variable and non-recurring components of overall compensation and benefits of all types paid or assigned during the year ended to Daniel Tassé, Chief Executive Officer,

|

| 21. | Approval of the fixed, variable and non-recurring components of overall compensation and benefits of all types paid or assigned during the year ended to Marie-Catherine Théréné, Deputy Chief Executive Officer until September 17, 2020,

|

| 22. | Authorization to be granted to the Board of Directors to buy back company shares on the Company’s behalf pursuant to Article L. 22-10-62 of the French Commercial Code, length of authorization, purpose, terms, and maximum amount, suspension during a public offering period,

|

Within the authority of the Extraordinary Shareholders’ Meeting:

| 23. | Authorization to be granted to the Board of Directors for the company to cancel the shares bought back pursuant to Article L. 22-10-62 of the French Commercial Code, length of authorization, maximum amount, suspension during a public offering period,

|

| 24. | Delegation of powers to the Board of Directors to issue ordinary shares, giving, as necessary, access to ordinary shares or to the allocation of debt securities (of the Company or of a Group company) and/or securities giving access to ordinary shares (of the Company or of a Group company) with pre-emptive rights, suspension during a public offering period,

|

| 25. | Delegation of powers to be granted to the Board of Directors to issue ordinary shares giving access, as the case may be, to ordinary shares or to the allocation of debt securities (of the Company or a group company), and/or securities giving access to ordinary shares (of the Company or a group company), without pre-emptive rights, by means of a public offer (excluding the offers set out in section 1 of Article L.411-2 of the French Monetary and Financial Code), and/or as consideration for securities in the context of a public exchange offer, suspension during a public offering period,

|

| 26. | Delegation of powers to be granted to the Board of Directors to issue ordinary shares giving access, as the case may be, to ordinary shares or to the allocation of debt securities (of the Company or a group company), and/or securities giving access to ordinary shares (of the Company or a group company), without pre-emptive rights, by means of a public offer referred to in paragraph 1 of Article L.411-2 of the French Monetary and Financial Code, suspension during a public offering period,

|

| 27. | Authorization, in the event of an issue without pre-emptive rights, to set the issue price according to the terms set by the General Meeting, within a limit of 10% of the capital per year,

|

| 28. | Delegation of powers to be granted to the Board of Directors to issue ordinary shares, giving, if applicable, access to ordinary shares or the allocation of debt securities (of the Company or a group company) and/or securities giving access to ordinary shares (of the Company or a group company), with pre-emptive subscription rights waived in favor of categories of persons with certain characteristics, suspension during a public offering period,

|

| 29. | Authorization to increase the total amount of issues,

|

| 30. | Delegation of powers to be granted to the Board of Directors for the purpose of deciding on any merger-absorption, demerger, or partial contribution of assets,

|

| 31. | Delegation of powers to be granted to the Board of Directors to issue ordinary shares giving access to ordinary shares or to the allocation of debt securities (of the Company or of a Group company), and/or securities giving access to ordinary shares (of the Company or of a Group company), in the context of a merger, demerger or partial contribution of assets decided by the Board of Directors pursuant to the delegation referred to in the thirtieth resolution, suspension during a public offering period,

|

| 32. | Overall limit on the maximum authorized amounts set under the 25th, 26th, 28th and 31st resolutions of this Meeting and the 28th resolution of the General Meeting of April 20, 2020,

|

| 33. | Delegation of powers to the Board of Directors to issue stock warrants (BSA), subscription and/or acquisition of new and/or existing stock warrants (BSAANE) and/or subscription and/or acquisition of new and/or existing redeemable stock warrants (BSAAR) with cancellation of preferential subscription rights, reserved for a category of persons, suspension during a public offering period,

|

| 34. | Delegation of powers to be granted to the Board of Directors to increase the share capital by means of the issue of ordinary shares and/or securities giving access to capital, with pre-emptive subscription rights waived in favor of members of a company savings plan pursuant to Articles L.3332-18 et seq. of the French Labor Code,

|

| 35. | Authorization to be granted to the Board of Directors to allocate free existing and/or future shares to members of staff and/or certain corporate officers of the Company or related companies or economic interest groups, with shareholders waiving their pre-emptive rights, length of authorization, maximum amount, duration of vesting periods specifically in respect of disability and, if applicable, holding periods,

|

| 36. | Authorization to be granted to the Board of Directors to grant share subscription and/or purchase options (stock options) to members of staff and/or certain corporate officers of the company or related companies or economic interest groups, with shareholders waiving their pre-emptive rights, length of authorization, maximum amount, strike price, maximum term of the option.

|

| 37. | Amendment of Article 13 of the by-laws in order to set the age limit for the Chairman of the Board of Directors at 75 years of age, and

|

| 38. | Powers to complete formalities.

|

What if another matter is properly brought before the meeting?

At this time, the board of directors is unaware of any matters to be presented at the Annual General Meeting, other than as set forth above and the possible additional shareholder resolutions that may properly be submitted before the Annual General Meeting in accordance with applicable French law.

Holders of Ordinary Shares: To address the possibility of another matter being presented at the Annual General Meeting, holders of Ordinary Shares may use their proxy card to (i) abstain from voting on such matters, (ii) vote “AGAINST” on such matters, or (iii) grant a proxy to the chairman of the Annual General Meeting to vote on any new matters that are proposed during the meeting, or (iv) grant a voting proxy to another shareholder, your spouse, or your partner with whom you have entered into a civil union. If no instructions are given with respect to matters about which we are currently unaware, your Ordinary Shares will not be voted on such matters.

If a holder of Ordinary Shares chooses to grant a proxy to the chairman of the Annual General Meeting, with respect to either all matters or only any additional matters not disclosed in this proxy statement, the chairman of the Annual General Meeting shall issue a vote in favor of adopting such undisclosed resolutions submitted or approved by the board of directors and a vote against adopting any other such undisclosed resolutions.

Holders of ADSs: Ordinary Shares underlying ADSs will not be voted on any matter not disclosed in the proxy statement.

Why is the Company soliciting my proxy?

Our board of directors is soliciting your proxy to vote at the 2021 annual meeting of shareholders to be held at the Company’s headquarters located at 177-181 Avenue Pierre Brossolette – 92120 Montrouge, France, on Wednesday, May 19, 2021, at 2:00 p.m. Paris time in closed session without the physical presence of the

shareholders and any adjournments or postponements of the meeting, which we refer to as the annual meeting. This proxy statement, along with the accompanying Notice of Annual Meeting of Shareholders, summarizes the purposes of the meeting and the information you need to know to vote at the annual meeting.

We have sent you this proxy statement, the Notice of Annual Meeting of Shareholders, the proxy card and a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 because you owned our ordinary shares or ADSs on April 21, 2021. We intend to commence distribution of the proxy materials to shareholders on or about May 3, 2021, in accordance with French law and requirements.

Who may vote?

Ordinary shareholders of record and bearer shareholders

In accordance with article R. 225-85 of the French Commercial Code only those holderson the compensation of corporate officers for the year ended December 31, 2023

| | “FOR” vote of a majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR | | | | | Approval of the fixed, variable and non-recurring components of overall compensation and benefits of all types paid or assigned during the year ended December 31, 2023, to Mr. Michel de Rosen, Chairman of the Board of Directors | | “FOR” vote of a majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR | | | | | Approval of the fixed, variable and non-recurring components of overall compensation and benefits of all types paid or assigned during the year ended December 31, 2023, to Mr. Daniel Tassé, Chief Executive Officer | | “FOR” vote of a majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR |

2

| | | | | Proposals | | Voting Standard | | Board Recommendation | | Advisory opinion on the compensation of named executive officers other than the Chief Executive Officer | | “FOR” vote of a majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR | | | | | Approval of the compensation policy for the Chairman of the Board of Directors for the year ending December 31, 2024 | | “FOR” vote of a majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR | | | | | Approval of the compensation policy for the Directors for the year ending December 31, 2024 | | “FOR” vote of a majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR | | | | | Approval of the compensation policy for the Chief Executive Officer and Deputy Chief Executive Officer for the year ending December 31, 2024 | | “FOR” vote of a majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR | | | | | Authorization to be granted to the Board of Directors to buy back company shares on the Company’s behalf pursuant to Article L.22-10-62 of the French Commercial Code | | “FOR” vote of a majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR | | | | | Delegation to be granted to the Board of Directors for the company to cancel the shares bought back pursuant to Article L.22-10-62 of the French Commercial Code | | “FOR” vote of 2/3 majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR | | | | | Reverse split of the Company’s shares by allocation of one new share with a par value of €1 for ten (10) existing shares with a par value of €0.10 each and delegation of powers to the Board of Directors for the purpose of implementing the reverse split | | “FOR” vote of 2/3 majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR |

3

| | | | | Proposals | | Voting Standard | | Board Recommendation | | Delegation of powers to be granted to the Board of Directors to issue ordinary shares and/or equity securities giving access to other equity securities or to the allocation of debt securities and/or securities giving access to ordinary shares with pre-emptive rights | | “FOR” vote of 2/3 majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR | | | | | Delegation of powers to be granted to the Board of Directors to issue ordinary shares and/ or equity securities giving access to other equity securities or to the allocation of debt securities, and/or securities giving access to equity securities to be issued, without pre-emptive rights, by means of a public offer (excluding the offers set out in paragraph 1 of Article L.411-2 of the French Monetary and Financial Code), and/or as consideration for securities in the context of a public exchange offer | | “FOR” vote of 2/3 majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR | | | | | Delegation of powers to be granted to the Board of Directors to issue ordinary shares and/ or equity securities giving access, as the case may be, to equity securities or to the allocation of debt securities (of the Company or a group company), and/or securities giving access to ordinary shares (of the Company or a group company), without pre-emptive rights, by means of a public offer referred to in paragraph 1 of Article L.411-2 of the French Monetary and Financial Code | | “FOR” vote of 2/3 majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR | | | | | Authorization, in the event of an issue without pre-emptive rights, to set the issue price according to the terms set by the General Meeting, within a limit of 10% of the capital per year | | “FOR” vote of 2/3 majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR | | | | | Delegation of powers to be granted to the Board of Directors to issue ordinary shares, giving, as the case may be, access to ordinary shares or the allocation of debt securities (of the Company or a group company) and/or securities giving access to ordinary shares (of the Company or a group company), with pre-emptive subscription rights waived in favor of a category of persons meeting specified characteristics | | “FOR” vote of 2/3 majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR |

4

| | | | | Proposals | | Voting Standard | | Board Recommendation | Delegation of powers to be granted to the Board of Directors to decide on the issue of ordinary shares who can prove their status by having their shares registered in their name,to be issued immediately or in the namefuture by the Company, with pre-emptive subscription rights waived in favor of a category of persons meeting specified characteristics within the framework of an intermediary duly registered on their behalf,equity financing agreement on the second business day priorUnited States stock market known as “At-The-Market” or “ATM Program” | | “FOR” vote of 2/3 majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR | | | | | Delegation of powers to be granted to the Board of Directors, in the case of a capital increase with existing shareholders’ preferential subscription rights maintained or waived, to increase the number of shares to be issued in the event of excess demand for subscriptions | | “FOR” vote of 2/3 majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR | | | | | Delegation of powers to be granted to the Board of Directors to increase the capital by means of the issue of ordinary shares and/or securities giving access to the capital, up to the limit determined by applicable laws and regulations at the time of the capital increase, in consideration for contributions in kind of securities or securities giving access to the capital | | “FOR” vote of 2/3 majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR | | | | | Delegation of powers to be granted to the Board of Directors for the purpose of deciding on any operation of merger-absorption, demerger, or partial contribution of assets | | “FOR” vote of 2/3 majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR | | | | | Delegation of powers to be granted to the Board of Directors to issue ordinary shares giving, as the case may be, access to ordinary shares or to the allocation of debt securities (of the Company or of a Group company), and/or securities giving access to ordinary shares (of the Company or of a Group company), in the context of an operation of merger, demerger or partial contribution of assets decided by the Board of Directors pursuant to the delegation referred to in the twenty-eighth resolution | | “FOR” vote of 2/3 majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR |

5

| | | | | Proposals | | Voting Standard | | Board Recommendation | | Overall limit on the maximum authorized amounts set under the resolutions twenty-first, twenty-second, twenty-fourth, twenty-fifth, twenty-sixth, twenty-seventh and twenty-ninth resolutions | | “FOR” vote of 2/3 majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR | | | | | Delegation of powers to be granted to the Board of Directors to increase the capital by means of the incorporation of reserves, profits and/or premiums | | “FOR” vote of 2/3 majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR | | | | | Delegation of powers to be granted to the Board of Directors to increase the capital by the issue of ordinary shares and/or securities giving access to the capital, with pre-emptive subscription rights waived in favor of the members of a company savings plan pursuant to Articles L.3332-18 and seq. of the French Labor Code | | “FOR” vote of 2/3 majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR | | | | | Delegation of powers to be granted to the Board of Directors to issue stock warrants (BSA), subscription and/or acquisition of new and/or existing stock warrants (BSAANE) and/or subscription and/or acquisition of new and/or existing redeemable stock warrants (BSAAR) with pre-emptive subscription rights waived in favor of a category of persons | | “FOR” vote of 2/3 majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR | | | | | Authorization to be granted to the Board of Directors to allocate for free existing and/or to be issued shares to employees and/or certain corporate officers of the company or related companies or economic interest groups | | “FOR” vote of 2/3 majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR | | | | | Authorization to be granted to the Board of Directors to grant options to subscribe and/or purchase shares (stock options) to employees and/or certain officers of the Company or related companies or economic interest groups | | “FOR” vote of 2/3 majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR | | | | | Ratification of the headquarters’ transfer decided by the Board of Directors | | “FOR” vote of 2/3 majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR |

6

| | | | | Proposals | | Voting Standard | | Board Recommendation | | Consequential amendment of article 3 on the Company’s bylaws | | “FOR” vote of 2/3 majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR | | | | | Powers to complete formalities | | “FOR” vote of a majority of the votes cast by the shareholders present in person, represented by proxy, or voting by mail at the Annual General Meeting and entitled to vote thereon. | | FOR |

7

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING The information provided in the “question and answer” format below is for your convenience only and is merely a summary of the information contained in this proxy statement. You should read this entire proxy statement carefully. Information contained on, or that can be accessed through, our website is not intended to be incorporated by reference into this proxy statement and references to our website address in this proxy statement are inactive textual references only. What matters will be voted at the Annual General Meeting? There are 38 proposed resolutions (the “Proposals”) scheduled to be considered and voted on at the Annual General Meeting: Within the authority of the Ordinary Shareholders’ Meeting: | 1. | Approval of the annual financial statements for the year ended December 31, 2023 |

| 2. | Approval of the consolidated financial statements for the year ended December 31, 2023 |

| 3. | Allocation of income for the year ended December 31, 2023 |

| 4. | Allocation of the accumulated deficit to the “Additional paid-in capital” |

| 5. | Statutory auditors’ special report on regulated agreements and acknowledgement of the absence of new regulated agreements |

| 6. | Renewal of Ms. Adora Ndu, as director |

| 7. | Renewal of Ms. Julie O’Neill, as director |

| 8. | Renewal of Ms. Danièle Guyot-Caparros, as director |

| 9. | Renewal of Mr. Ravi M. Rao, as director |

| 10. | Approval of the information set out in section I of Article L.22-10-9 of the French Commercial Code on the compensation of corporate officers for the year ended December 31, 2023 |

| 11. | Approval of the fixed, variable and non-recurring components of overall compensation and benefits of all types paid or assigned during the year ended December 31, 2023, to Mr. Michel de Rosen, Chairman of the Board of Directors |

| 12. | Approval of the fixed, variable and non-recurring components of overall compensation and benefits of all types paid or assigned during the year ended December 31, 2023, to Mr. Daniel Tassé, Chief Executive Officer |

| 13. | Advisory opinion on the compensation of named executive officers other than the Chief Executive Officer |

| 14. | Approval of the compensation policy for the Chairman of the Board of Directors for the year ending December 31, 2024 |

| 15. | Approval of the compensation policy for the Directors for the year ending December 31, 2024 |

| 16. | Approval of the compensation policy for the Chief Executive Officer and Deputy Chief Executive Officer for the year ending December 31, 2024 |

| 17. | Authorization to be granted to the Board of Directors to buy back company shares on the Company’s behalf pursuant to Article L.22-10-62 of the French Commercial Code |

8

Within the authority of the Extraordinary Shareholders’ Meeting: | 18. | Delegation to be granted to the Board of Directors for the company to cancel the shares bought back pursuant to Article L.22-10-62 of the French Commercial Code |

| 19. | Reverse split of the Company’s shares by allocation of one new share with a par value of €1 for ten (10) existing shares with a par value of €0.10 each and delegation of powers to the Board of Directors for the purpose of implementing the reverse split |

| 20. | Delegation of powers to be granted to the Board of Directors to issue ordinary shares and/or equity securities giving access to other equity securities or to the allocation of debt securities and/or securities giving access to ordinary shares with pre-emptive rights |

| 21. | Delegation of powers to be granted to the Board of Directors to issue ordinary shares and/ or equity securities giving access to other equity securities or to the allocation of debt securities, and/or securities giving access to equity securities to be issued, without pre-emptive rights, by means of a public offer (excluding the offers set out in paragraph 1 of Article L.411-2 of the French Monetary and Financial Code), and/or as consideration for securities in the context of a public exchange offer |

| 22. | Delegation of powers to be granted to the Board of Directors to issue ordinary shares and/ or equity securities giving access, as the case may be, to equity securities or to the allocation of debt securities (of the Company or a group company), and/or securities giving access to ordinary shares (of the Company or a group company), without pre-emptive rights, by means of a public offer referred to in paragraph 1 of Article L.411-2 of the French Monetary and Financial Code |

| 23. | Authorization, in the event of an issue without pre-emptive rights, to set the issue price according to the terms set by the General Meeting, within a limit of 10% of the capital per year |

| 24. | Delegation of powers to be granted to the Board of Directors to issue ordinary shares, giving, as the case may be, access to ordinary shares or the allocation of debt securities (of the Company or a group company) and/or securities giving access to ordinary shares (of the Company or a group company), with pre-emptive subscription rights waived in favor of a category of persons meeting i.e. Monday, May 17, 2021specified characteristics |

| 25. | Delegation of powers to be granted to the Board of Directors to decide on the issue of ordinary shares to be issued immediately or in the future by the Company, with pre-emptive subscription rights waived in favor of a category of persons meeting specified characteristics within the framework of an equity financing agreement on the United States stock market known as “At-The-Market” or “ATM Program” |

| 26. | Delegation of powers to be granted to the Board of Directors, in the case of a capital increase with existing shareholders’ preferential subscription rights maintained or waived, to increase the number of shares to be issued in the event of excess demand for subscriptions |

| 27. | Delegation of powers to be granted to the Board of Directors to increase the capital by means of the issue of ordinary shares and/or securities giving access to the capital, up to the limit determined by applicable laws and regulations at midnightthe time of the capital increase, in consideration for contributions in kind of securities or securities giving access to the capital |

| 28. | Delegation of powers to be granted to the Board of Directors for the purpose of deciding on any operation of merger-absorption, demerger, or partial contribution of assets |

| 29. | Delegation of powers to be granted to the Board of Directors to issue ordinary shares giving, as the case may be, access to ordinary shares or to the allocation of debt securities (of the Company or of a Group company), and/or securities giving access to ordinary shares (of the Company or of a Group company), in the context of an operation of merger, demerger or partial contribution of assets decided by the Board of Directors pursuant to the delegation referred to in the twenty-eighth resolution |

| 30. | Overall limit on the maximum authorized amounts set under the resolutions twenty-first, twenty-second, twenty-fourth, twenty-fifth, twenty-sixth, twenty-seventh and twenty-ninth resolutions |

9

| 31. | Delegation of powers to be granted to the Board of Directors to increase the capital by means of the incorporation of reserves, profits and/or premiums |

| 32. | Delegation of powers to be granted to the Board of Directors to increase the capital by the issue of ordinary shares and/or securities giving access to the capital, with pre-emptive subscription rights waived in favor of the members of a company savings plan pursuant to Articles L.3332-18 and seq. of the French Labor Code |

| 33. | Delegation of powers to be granted to the Board of Directors to issue stock warrants (BSA), subscription and/or acquisition of new and/or existing stock warrants (BSAANE) and/or subscription and/or acquisition of new and/or existing redeemable stock warrants (BSAAR) with pre-emptive subscription rights waived in favor of a category of persons |

| 34. | Authorization to be granted to the Board of Directors to allocate for free existing and/or to be issued shares to employees and/or certain corporate officers of the company or related companies or economic interest groups |

| 35. | Authorization to be granted to the Board of Directors to grant options to subscribe and/or purchase shares (stock options) to employees and/or certain officers of the Company or related companies or economic interest groups |

| 36. | Ratification of the headquarters’ transfer decided by the Board of Directors |

| 37. | Consequential amendment of article 3 on the Company’s bylaws |

Within the authority of the Ordinary Shareholders’ Meeting: | 38. | Powers to complete formalities. |

What does a DBV ADS represent? Each ADS represents one-half of one Ordinary Share of DBV Technologies S.A. Each Ordinary Share is entitled to one vote. As of March 31, 2024, 96, 434, 369 Ordinary Shares were outstanding, of which 23, 081,400 were represented by 46,162,800 ADSs. What if another matter is properly brought before the meeting? At this time, the Board of Directors is unaware of any matters to be presented at the Annual General Meeting, other than as set forth above and the possible additional shareholder resolutions that may properly be submitted before the Annual General Meeting in accordance with applicable French law. Holders of Ordinary Shares: To address the possibility of another matter being presented at the Annual General Meeting, holders of Ordinary Shares may use their proxy card to (i) abstain from voting on such matters, (ii) vote “AGAINST” on such matters, or (iii) grant a proxy to the chairman of the Annual General Meeting to vote on any new matters that are proposed during the meeting, or (iv) grant a voting proxy to another shareholder, their spouse, or their partner with whom they have entered into a civil union. If no instructions are given with respect to matters about which we are currently unaware, holder’s Ordinary Shares will not be voted on such matters. If a holder of Ordinary Shares chooses to grant a proxy to the chairman of the Annual General Meeting, with respect to either all matters or only any additional matters not disclosed in this proxy statement, the chairman of the Annual General Meeting shall issue a vote in favor of adopting such undisclosed resolutions submitted or approved by the Board of Directors and a vote against adopting any other such undisclosed resolutions. Holders of ADSs: Ordinary Shares underlying ADSs will not be voted on any matter not disclosed in the proxy statement. 10

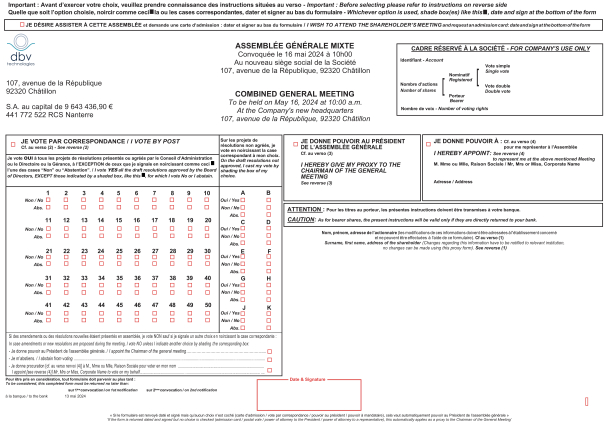

Why is the Company soliciting my proxy? Our Board of Directors is soliciting your proxy to vote at the 2024 annual meeting of shareholders to be held at the Company’s new headquarters located at 107 avenue de la République 92320 Châtillon, France, on May 16, 2024, at 10:00 AM Paris time. This proxy statement, along with the accompanying Notice of Annual Meeting of Shareholders, summarizes the purposes of the meeting and the information you need to know to vote at the annual meeting. We have sent you this proxy statement, the Notice of Annual Meeting of Shareholders, the proxy card and a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, because you owned our Ordinary Shares or ADSs on April 25, 2024. Our Depositary, Citibank, N.A., intends to commence mailing the proxy materials to holders of our ADSs on or about April 30, 2024. Our registrar, Société Générale Securities Services intends to commence distribution of the proxy materials to shareholders of Ordinary Shares on or about April 29, 2024, in accordance with French law and requirements. Who may vote? Ordinary shareholders of record and bearer shareholders If you are a holder of Ordinary Shares at zero hour Paris time on May 14, 2024 you will be eligible to vote at the Annual General Meeting. In deciding all matters at the Annual General Meeting, each shareholder will be entitled to one vote for each share of our Ordinary Shares held by them on the record date. In accordance with article R. 225-85 of the French Commercial Code, only those holders of Ordinary Shares who can prove their status by having their shares registered in their name, or in the name of an intermediary duly registered on their behalf, on the second business day prior to the meeting, i.e. May 14, 2024 at zero hour Paris time (the “Ordinary Share Record Date”), either in the registered share accounts or in the bearer share accounts held by their authorized intermediary, will be eligible to vote. For registered shareholders, this registration in the registered share accounts on the Ordinary Share Record Date is sufficient to enable them to vote their Shares. For bearer shareholders, it is the authorized intermediaries who maintain the bearer share accounts who directly prove their clients’ status as shareholders to Société Générale Securities Services (the centralizing institution for the meeting mandated by DBV Technologies) by producing a certificate of participation which they attach to the single postal voting or proxy form drawn up in the name of the shareholder or on behalf of the shareholder represented by the registered intermediary. Holders of American Depositary Shares If you are a registered holder of ADSs on the books of Citibank, N.A. on April 21, 202125, 2024 (the “ADS Record Date”), then at or prior to 10:00 a.m.AM Eastern Time on May 12, 2021,10, 2024, you may provide instructions to the Depositary as to how to vote the Ordinary Shares underlying your ADSs on the issues set forth in this proxy statement. The Depositary will mail you a voting instruction card if you hold ADSs in your own name on the Depositary’s share register (“Registered Holders”). If, however, on the ADS Record Date you held your ADSs through a bank, broker, custodian or other nominee/agent (“Beneficial Holders”), it is anticipated that such bank, broker, custodian or nominee/agent will forward voting instruction forms to you. | | • | | Registered holdersHolders. Registered holders of ADSs must complete, sign and return a Voting Instruction Form to be actually received by the Depositary on or prior to 10:00 a.m.AM Eastern Time on May 12, 2021.10, 2024. |

| | • | | Street Name holdersBeneficial Holders. If our ADSs are held on your behalf in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of those ADSs held in “street name,” and this

|

11

| proxy statement was forwarded to you by your broker or nominee. A holder of ADSs held through a broker, bank or other nominee (a “beneficial holder of ADSs”) should follow the instructions that its broker, bank or other nominee provides to vote the Ordinary Shares underlying its ADSs. |

As an ADS holder, you will not be entitled to vote in person at the Annual General Meeting. To the extent you provide the Depositary or your broker, bank or other nominee, as applicable, with voting instructions, the Depositary will, to the extent practicable and subject to French law and the terms of the deposit agreement, vote the Ordinary Shares underlying your ADSs in accordance with your instructions. How many votes do I have? Each share of ourordinary shares Ordinary Shares that you own entitles you to one vote. Each American Depositary ShareADS represents one-half of one ordinary share.Ordinary Share. Voting instructions with respect to ADSs may be given only in respect of a number of ADSs representing an integral number of ordinary shares.Ordinary Shares. How will my Ordinary Shares be voted if I do not vote? If you hold Ordinary Shares and do not (i) grant your voting proxy directly to the chairman of the Annual General Meeting, (ii) vote in person at the Annual General Meeting, (iii) grant your voting proxy to another shareholder, your spouse, or your partner with whom you have entered into a civil union, (iii)(iv) vote by submitting your proxy card by mail or (iv)(v) vote electronically via Votaccess, your Ordinary Shares will not be counted as votes cast and will have no effect on the outcome of the vote with respect to any matter. If you hold Ordinary Shares and grant your voting proxy directly to the chairman of the Annual General Meeting without specifying how you wish to vote with respect to a particular matter, your Ordinary Shares will be voted in accordance with the boardBoard of directors’Directors’ recommendations. If you own Ordinary Shares in “street name” through a broker, bank or other nominee and you do not direct your broker how to vote your shares on the proposals, your shares will not be voted on any proposal on which the broker does not have discretionary authority to vote. This is referred to as a broker non-vote. We believe that all of our proposals are non-routine matters and your broker cannot vote your shares for which you have not provided voting instructions. Broker non-votes on a particular proposal will not be counted as votes cast and will have no effect on the outcome of the vote with respect to such matter. How will the Ordinary Shares underlying my ADSs be voted if I do not provide voting instructions to the Depositary or my broker, bank or other nominee? With respect to Ordinary Shares represented by ADSs for which no timely voting instructions are received by the Depositary from a holder of ADSs, the Depositary shall not vote such Ordinary Shares. The Depositary will not itself exercise any voting discretion in respect of any Ordinary Shares. If you own ADSs in “street name” through a broker, bank or other nominee and you do not direct your broker how to instruct the Depositary how to vote the Ordinary Shares represented by your ADSs on the proposals, your shares will not be voted on any proposal on which the broker does not have discretionary authority to provide voting instructions to the Depositary. This is referred to as a broker non-vote. We believe that all of our proposals are non-routine matters and your broker cannot provide voting instructions to the Depositary with respect to how to vote the Ordinary Shares represented by your ADSs for which you have not provided voting instructions. Broker non-votes on a particular proposal will not be counted as votes cast and will have no effect on the outcome of the vote with respect to such matter. 12

How will my Ordinary Shares be voted if I grant my proxy to the chairman of the Annual General Meeting? If you are a holder of Ordinary Shares and you grant your proxy to the chairman of the Annual General Meeting, the chairman of the Annual General Meeting will vote your Ordinary Shares in accordance with the boardBoard of directors’Directors’ recommendations. As a result, your Ordinary Shares would be voted “FOR” the nominees of the boardBoard of directorsDirectors in Proposal Nos. 6 to 109 and “FOR” each of Proposal Nos. 1 to 5 11and 10 to 15, and 18 to 38 and “AGAINST” each of Proposal Nos. 16 and 17.38. How many votes are needed for approval of each proposed resolution? | | • | | Proposal Nos. 1 to 22:17 and Proposal 38: The affirmative vote of a majority of the total number of votes cast is required for the election of each director nominee in Proposal Nos. 6 to 109 and for the approval of each matter described in Proposal Nos. 1 to 5, 10 to 17, and 11 to 23. Under French law, this means that the votes cast “FOR” a nominee must exceed the aggregate of the votes cast “AGAINST” that nominee, and the votes cast “FOR” a resolution must exceed the aggregate of the votes cast “AGAINST” that resolution.38. |

| | • | | Proposal Nos. 23 18 to 38:37: For approval of Proposal Nos. 23 through 38,18 to 37, the affirmative vote of two-thirds of the total number of votes cast is required. |

What is an “abstention” and how would it affect the vote? With respect to Ordinary Shares, an “abstention” occurs when a shareholder votes by mail with instructions to abstain from voting regarding a particular matter or without making a selection with respect to a particular matter. With respect to ADSs, an abstention occurs when a holder of ADSs sends proxy instructions to the Depositary to abstain from voting regarding a particular matter or without making a selection with respect to a particular matter. Abstentions by holders of Ordinary Shares or by holders of ADSs will not be counted toward a quorum and will not be counted as votes cast and will have no effect on the outcome of the vote on matters on which a holder has abstained. Who will count the votes at the Annual General Meeting? Representatives of Société Générale Securities Services and our legal department will tabulate the votes and act as inspectors of election. What Constitutes a Quorum for the Annual Meeting? Consistent with French law, our by-laws provide that a quorum requires the presence of shareholders having at least (1) 20% of the shares entitled to vote in the case of an ordinary shareholders’ general meeting or at an extraordinary shareholders’ general meeting where shareholders are voting on a capital increase by capitalization of reserves, profits or share premium, or (2) least: | (1) | 20% of the shares entitled to vote in the case of an ordinary shareholders’ general meeting or at an extraordinary shareholders’ general meeting where shareholders are voting on a capital increase by capitalization of reserves, profits or share premium, or |

| (2) | 25% of the shares entitled to vote in the case of any other extraordinary shareholders’ general meeting. |

How can I vote my ordinary shares?Ordinary Shares or ADSs? Due to the COVID-19 pandemic, the Annual General Meeting will be held in closed session without the physical presence of shareholders and other persons entitled to attend, in accordance with Article 4 of Order No. 2020-321 of 25 March 2020 adapting the rules for meetings and deliberations of meetings and governing bodies of legal persons and entities without legal personality under private law due to the COVID-19 pandemic, as amended and extended, among others, by Order No. 2020-1497 of 2 December 2020 extending and amending Order No. 2020-321 of 25 March 2020 and by Decree no. 2021-255 of 9 March 2021 extending the period of application of Order No. 2020-321 of 25 March 2020, Decree no. 2020-418 of 10 April 2020 and Decree no. 2020-629 of 25 May 2020, Therefore, we urge you to vote by proxy as you may not attend the meeting in person. All shares represented by valid proxies that we receive through this solicitation, and that are not revoked, will be voted in accordance with your instructions on the proxy card or as instructed via the Internet or telephone. You may specify whether your shares should be voted for, against or abstain with respect to each proposal. If you properly submit a proxy without giving specific voting instructions, your shares will be voted in accordance with our board of directors’ recommendations as noted below.hold Ordinary Shares

In order to facilitate their participation in the Annual General Meeting, the Company offers its holders of ordinary sharesOrdinary Shares the possibility of voting via Votaccess. The Votaccess website will be open from Monday, May 3, 2021April 26, 2024, at 9:00 a.m.AM Paris time to Tuesday, May 18, 202115, 2024, at 3:00 p.m.PM Paris time. 13

In order to avoid any possible bottleneck on the Votaccess platform, shareholders are strongly recommended not to wait until the end of the opening period of Votaccess to enter their instructions. Only holders of bearer shares whose account-holding institution has subscribed to the Votaccess system and offers them this service for this general meeting will be able to access it. The securities account holder of the bearer shareholder, who does not subscribe to Votaccess or who makes access to the site subject to conditions of use, will indicate to the shareholder how to proceed. Shareholders wishing to participate in the Annual General Meeting may choose one of the following options: vote in person at the Annual General Meeting; give your voting proxy to the chairman of the general meeting Annual General Meeting; grant your voting proxy to another shareholder, your spouse, or your partner with whom you have entered into a civil union; or vote by mail or via Votaccess;Votaccess. You may vote in person at the Annual General Meeting so long as you do not submit your proxy card by mail or appoint a proxy in advance of the meeting. Shareholders who have chosen to vote by mail or to give aproxy to the Chairman or to grant a voting proxy to another shareholder, your spouse, or your partner with whom you have entered into a civil union, using the single form or via Votaccess may: If you are a registered shareholder: by mail, return the single form for voting by mail or by proxy that will be sent to you with the notice of meeting using the enclosed T envelope no later than Saturday, May 15, 2021, 11:59 p.m., Paris Time; or by Internet, log on to www.sharinbox.societegenerale.com no later than 3:00 p.m., Paris Time, Tuesday, May 18, 2021;

| • | | in the case of registered shareholders: by mail, return the single form for voting by mail that will be sent to you with the notice of meeting using the enclosed envelope no later than May 13, 2024, 11:59 PM Paris Time; or via Votaccess, log on tohttps://sharinbox.societegenerale.com/en/shareholders no later than May 15, 2024, 3:00 PM Paris Time; |

in the case of bearer shareholders: by post, request this form from the financial intermediary with which their shares are registered, as of the date of the meeting, which request must be received at least six days prior to the date of the meeting, at the following address Société Générale, Service des Assemblées (CS 30812—30812 – 44308 Nantes Cedex 3) no later than Saturday, May 15, 2021,13, 2024, 11:59 p.m.PM., Paris Time; or via Internet, log on to the portal of its securities account holder to access the Votaccess site in accordance with the terms and conditions set out below, no later than May 15, 2024, 3:00 p.m., Paris Time, Tuesday, May 18, 2021,PM Paris time. Postal votes cast by paper means will only be taken into account if the duly completed and signed forms (and accompanied by the certificate of participation for bearer shares) reach the aforementioned Meetings Department of Société Générale at least three days before the date of the general meeting, i.e., no later than Saturday, May 15, 2021,13, 2024, 11:59 PM Paris time. In accordance with the provisions of Article R. 225-79 of the French Commercial Code, notification of the appointment and revocation of a proxy to the Chairman or to another shareholder, your spouse, or your partner with whom you have entered into a civil union, may also be made in the following manner: by post, using the voting form sent either directly for registered shareholders, using the prepaid reply envelope attached to the notice of meeting, or by the holder of the share account for bearer shareholders and received by the Société Générale, Service des Assemblées (CS 30812 – 44 308 Nantes Cedex 3) no later than May 13, 2024, 11:59 p.m. Paris time; by electronic means, by connecting, for registered shareholders to the www.sharinbox.societegenerale.com website, for bearer shareholders to the portal of their securities account holder to access the Votaccess website, in accordance with the terms and conditions described below, no later than May 15, 2024, 3:00 PM Paris time. 14

In addition, if you give a proxy vote to another shareholder, to your spouse or to your partner with whom you have entered into a civil union, the voting proxy needs to address its voting instructions to Société Générale for the exercise of its mandates in the form of a scanned copy of the single form, by e-mail to the following address: assemblees.generales@sgss.socgen.com. The form must bear the surname, first name and address of the person being named as proxy, the words “In the capacity of proxy”, and must be dated and signed. The direction of the vote must be indicated in the “I vote by mail” box of the form. The proxy must attach a copy of his or her identity card and, if applicable, a power of attorney from the legal entity he/she represents. To be taken into account, the electronic message must be received by Société Générale no later than the fourth day prior to the date of the meeting, which is Saturday, May 15, 2021. In accordance with the provisions of Article R. 225-79 of the French Commercial Code, notification of the appointment and revocation of a proxy to the Chairman may also be made in the following manner:

by post, using the voting form sent either directly for registered shareholders, using the prepaid reply envelope attached to the notice of meeting, or by the holder of the share account for bearer shareholders and received by the Société Générale, Service des Assemblées (CS 30812 - 44 308 Nantes Cedex 3) no later than Saturday, May 15, 2021, 11:59 p.m. Paris Time;

by electronic means, by connecting, for registered shareholders to the www.sharinbox.societegenerale.com website, for bearer shareholders to the portal of their securities account holder to access the Votaccess website, in accordance with the terms and conditions described below, no later than Tuesday, May 18, 2021 at 3:00p.m., Paris time.

As an exception to Section III of Article R. 225-85 of the French Commercial Code and in accordance Article 7 of Decree No. 2020-418 of April 10, 2020 adapting the rules of meeting and deliberation of the assemblies and governing bodies of legal persons and entities without legal personality under private law due to the COVID-19 pandemic, a shareholder who has already voted by mail, or sent a proxy to the Chairman may choose another means of participating in the meeting, provided that his/her/it instructions to this effect reaches the Company within the time required for the new mode of participation chosen. However, if a transfer of ownership occurs before the Ordinary Share Record Date, the Company shall invalidate or modify, as the case may be, the vote cast by mail, the proxy or the certificate of participation, as the case may be.

To this end, the authorized intermediary holding the account shall notify the Company or its agent of the transfer of ownership and provide it with the necessary information. No transfer of ownership made after Ordinary Share Record Date, regardless of the means used, shall be notified by the authorized intermediary holding the account or taken into consideration by the Company, notwithstanding any agreement to the contrary. It should be noted that for any proxy given by a shareholder without indication of a proxy holder, the chairman of the Annual General Meeting shall cast a vote in favor of the adoption of draft resolutions presented or approved by the Board of Directors, and a vote against the adoption of all other draft resolutions. Please also note that shareholders who wish to ask questions may submit these in writing, accompanied by the shareholder’s certificate of registration, to investors@dbv-technologies.cominvestors@dbv-technologies.com.. Questions must be receivedsubmitted by Monday, May 17, 202110, 2024, at 11:59 p.m.,PM Paris time. If you hold ADSs: If you are a holder of ADSs, you may give voting instructions to the Depositary or your broker, bank, or other nominee, as applicable, with respect to the Ordinary Shares underlying your ADSs. If you held ADSs as of the ADS Record Date, you have the right to instruct the Depositary - if you held your ADSs directly - or the right to instruct your broker, bank, or other nominee - if you held your ADSs through such intermediary - how to vote. If you are a registered holder of ADSs on the books of the Depositary as of the ADS Record Date, the Depositary will mail you a Voting Instruction Form. So long as the Depositary receives your Voting Instruction Form on or prior to 10:00 AM Eastern Time on May 10, 2024, it will, to the extent practicable and subject to French law and the terms of the deposit agreement, vote the underlying Ordinary Shares as you instruct. If your ADSs are held through a broker, bank, or other nominee as of the ADS Record Date, such intermediary will provide you with instructions on how you may give voting instructions with respect to the Ordinary Shares underlying your ADSs. Please check with your broker, bank, or other nominee, as applicable, and carefully follow the voting instructions provided to you. As an ADS holder, you will not be entitled to vote in person at the Annual General Meeting. To the extent you provide the Depositary or your broker, bank, or other nominee, as applicable, with voting instructions, the Depositary will, to the extent practicable and subject to French law and the terms of the deposit agreement, vote the Ordinary Shares underlying your ADSs in accordance with your instructions. How does the boardBoard of directorsDirectors recommend that I vote on the proposals? Our boardBoard of directorsDirectors recommends that you vote FOR”“FOR” the nominees to the boardBoard of directorsDirectors in Proposal Nos. 6 to 109 and “FOR” each of Proposal Nos. 1 to 5 11and 10 to 15, and 18 to 38 and “AGAINST” each of Proposal Nos. 16 and 17.38. What if I receive more than one proxy card? You may receive more than one proxy card if you hold shares in more than one account, which may be in registered form or held in street name. Please vote in the manner described above under “How Cancan I Votevote my Ordinary Shares or ADSs?” for each account to ensure that all of your shares are voted. 15

Is voting confidential? We will keep all the proxies, ballots and voting tabulations private. We only let our Inspector of Election examine these documents. Management will not know how you voted on a specific proposal unless it is necessary to meet legal requirements. We will, however, forward to management any written comments you make on the proxy card or that you otherwise provide. Where can I find the voting results of the Annual General Meeting? The preliminary voting results will be announced at the annual meeting, and we will publish preliminary results, or final results if available, in a Current Report on Form 8-K within four business days of the annual meeting. If final results are unavailable at the time we file the Form 8-K, then we will file an amended Current Report on Form 8-K to disclose the final voting results within four business days after the final voting results are known. What Are the Costs of Soliciting These Proxies? We will pay all of the costs of soliciting these proxies. Our directors and employees may solicit proxies in person or by telephone, fax or email. We will pay these employees and directors no additional compensation for these services. We will ask banks, brokers and other institutions, nominees and fiduciaries to forward these proxy materials to their principals and to obtain authority to execute proxies. We will then reimburse them for their expenses. Where is the Annual General Meeting? The annual meeting will be held at 2:00 p.m. Paris time on Wednesday, May 19, 2021 at the Company’s headquarters located at 177-181 Avenue Pierre Brossolette – 92120 Montrouge, France. However, due to the COVID-19 pandemic the Annual General Meeting will be held in closed session withoutat 10:00 AM, Paris time, on May 16, 2024 at the physical presence of shareholders and other persons entitled to attend, in accordance with Article 4 of Order No. 2020-321 of 25 March 2020 adapting the rules for meetings and deliberations of meetings and governing bodies of legal persons and entities without legal personality under private law due to the Covid-19 pandemic, as amended and extended, among others, by Order No. 2020-1497 of 2 December 2020 extending and amending Order No. 2020-321 of 25 March 2020 and by Decree no. 2021-255 of 9 March 2021 extending the period of application of Order No. 2020-321 of 25 March 2020, Decree no. 2020-418 of 10 April 2020 and Decree no. 2020-629 of 25 May 2020.Company’s new headquarters located at 107, avenue de la République 92320 Châtillon, France. On May 19, 2021,16, 2024, starting at 2:10:00 p.m.AM Paris time, the Annual General Meeting will be webcast with live audio on the Company’s website http://www.dbv-technologies.com/fr/www.dbv-technologies.com in the Events and Presentations section,, including the presentation of the results of the votes on the resolutions received by Société Générale Securities Services. Shareholders will also be able to access the recorded webcast of the Annual General Meeting on the Company’s website for twofive (5) years. Who may attend the Annual General Meeting? Holders of record of Ordinary Shares as of zero hour Paris time, on May 14, 2024 or their duly appointed proxies, may attend the Annual General Meeting. Holders of Ordinary Shares may request an admission card for the Annual General Meeting by checking the appropriate box on the proxy form, dating and signing it, and returning the proxy form by regular mail or may present evidence of their status as a shareholder at the Annual General Meeting as of zero hour Paris time, on May 14, 2024. Holders of ADSs will not be able to attend the Annual General Meeting. Can I vote in person at the Annual General Meeting? If you hold Ordinary Shares as of zero hour, Paris time, on May 14, 2024, you may vote in person at the Annual General Meeting unless you submit your proxy or voting instructions prior to the Annual General Meeting. If you hold ADSs, you will not be able to vote the Ordinary Shares underlying your ADSs in person at the Annual General Meeting. 16

I share an address with another holder of ADSs, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials? SEC rules concerning the delivery of annual disclosure documents allow us or your broker to send a single set of our proxy materials to any household at which two or more of our ADS holders of record reside, if we or your broker believe that the ADS holders of record are members of the same family. This practice, referred to as “householding,” benefits both you and us. It reduces the volume of duplicate information received at your household and helps to reduce our expenses. The rule applies to our annual reports, proxy statements and information statements. Once you receive notice from your broker or from us that communications to your address will be “householded,” the practice will continue until you are otherwise notified or until you revoke your consent to the practice. ADS holders who participate in householding will continue to have access to and utilize separate proxy voting instructions. If a broker or other nominee holds your ADSs and (1) your household received a single set of proxy materials this year, but you would prefer to receive your own copy or you do not wish to participate in householding and would like to receive your own set of our proxy materials in future years or (2) you share an address with another ADS holder and together both of you would like to receive only a single set of proxy materials, please contact the broker or other nominee directly and inform them of your request. Be sure to include your name, the name of your brokerage firm and your account number. Can I receive Company shareholder communications by electronic delivery? Most shareholders can elect to view or receive copies of future proxy materials over the Internet instead of receiving paper copies in the mail. You can choose this option and save us the cost of producing and mailing these documents by following the instructions provided on your proxy card or by following the instructions provided when you vote over the Internet. Where can I find documents referenced in this proxy statement? An English translation of the full text of the resolutions to be submitted to shareholders at the Annual General Meeting is included in Annex A of this proxy statement and this proxy statement will be accompanied by the Company’s Annual Report on Form 10-K, which includes the consolidated financial statements of the Company for the fiscal year ended December 31, 20202023 presented in accordance with generally accepted accounting principles in the United States. The Company’s Annual Report on Form 10-K was filed with the SEC on March 17, 20217, 2024, and is available on our website athttps://www.dbv-technologies.comwww.dbv-technologies.com.. In addition, once available, the following documents will be posted on our website athttps://www.dbv-technologieswww.dbv-technologies.com:: (i) an English translation of the statutory financial statements of the Company for the fiscal year ended December 31, 20202023 prepared in accordance with generally accepted accounting principles as applied to companies in France; (ii) an English translation of the consolidated financial statements of the Company for the fiscal year ended December 31, 20202023 prepared in accordance with International Financial Reporting Standards as adopted by the European Union; (iii) an English translation of the report of the boardBoard of directorsDirectors and the management report; and (iv) an English translation of the report of the statutory auditors concerning the statutory and consolidated financial statements of the Company for the fiscal year ended December 31, 2020,2023, as well as an English translation of the special report of the statutory auditors concerning the regulated agreements and acknowledgement of the absence of new related party transactions being presented to shareholders for approval in Proposal No. 5. You may obtain additional information, which we make available in accordance with French law, by contacting the Company until April 15, 2024 at DBV Technologies S.A., 177-181, avenue Pierre Brossolette – 92120 Montrouge and from April 16, 2024 at DBV Technologies S.A., 107 avenue de la République 92320 Châtillon, France, or by emailing investors@dbv-technologies.cominvestors@dbv-technologies.com.. Such additional information includes, but is not limited to, the statutory auditors’ reports referenced in the resolutions described below. 17

What is the deadline to propose actions for consideration at next year’s Annual General Meeting of shareholders or to nominate individuals to serve as directors? Shareholder Proposals Any holder of ADSs and/or Ordinary Shares desiring to present a resolution for inclusion in the Company’s proxy statement for the 20212025 Annual General Meeting of shareholders must deliver such resolution to the boardBoard of directorsDirectors at the address below no later than December 27, 2021.2024. Only those resolutions that comply with the requirements of Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), will be included in the Company’s proxy statement for the 20222025 Annual General Meeting of shareholders. In addition, under French law, holders of Ordinary Shares are permitted to submit a resolution for consideration so long as such matter is received by the Company no later than 25 days prior to the date of the meeting. Holders of Ordinary Shares wishing to present resolutions at the 20222024 Annual General Meeting of shareholders made outside of Rule 14a-8 under the Exchange Act must comply with the procedures specified under French law. A shareholder who meets the requirements set forth in Articles L. 225-105 and R. 225-71 of the French Commercial Code may submit a resolution by sending such resolution to the address below by registered letter with acknowledgment of receipt or via e-mail. The resolution must include the text of the proposed resolution, a brief explanation of the reason for such resolution and an affidavit to evidence the shareholder’s holdings. Any holder of Ordinary Shares who meets the requirements set forth in Articles L. 225-105 and R. 225-71 of the French Commercial Code also may submit a director nomination to be considered by the nomination and corporate governance committee for nomination by following the same process outlined above and including the information regarding the director as set forth in Article R. 225-83 5o5o of the French Commercial Code in their submission. In addition to satisfying the requirements under French law and our by-laws, to comply with the universal proxy rules, any holder of ADSs and/or Ordinary Shares who intends to solicit proxies in support of director nominees other than the Company’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than March 17, 2025. All submissions to the Company should be made to:made: DBV Technologies S.A.

177-181 avenue Pierre Brossolette

92120 Montrouge, France

Attention: Legal Department

Email : investors@dbv-technologies.com

| | | | Until April 15, 2024 | | From April 16, 2024 | | | To DBV Technologies S.A. 177-181, avenue Pierre Brossolette – 92120 Montrouge Attention: Legal Department Email: legal@dbv-technologies.com | | To DBV Technologies S.A. 107 avenue de la République 92320 Châtillon, France Attention: Legal Department Email: legal@dbv-technologies.com |

Nomination of Director Candidates Shareholders may recommend director candidates for consideration by our nominating and corporate governance committee.Nominating Committee. For additional information regarding our policy regarding shareholder recommendations for director candidates, see “Board of Directors“Shareholder Proposals and Corporate Governance—Shareholder RecommendationsNominations for Nominations to the Board of Directors.Director.” 18

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE Board of Directors Our business affairs are managed under the direction of our boardBoard of directors,Directors, which is currently composed of nineten members. SevenNine of our directors are independent within the meaning of the listing standards of the Nasdaq Stock Market.Nasdaq. The following table sets forth the names, ages as of April 14, 2021,8, 2024, and certain other information for each of the nominees for director each of the provisionally appointed directors subject to shareholder ratification, and for each of the continuing members of our boardBoard of directors:Directors: | | | | | | | | | | | Name | | Age | | | Position | | Term Expires | | Nominees for Director | | | | | | | | | | | Adora Ndu | | | 39 | | | Director Nominee | | | n/a | | Ravi Rao | | | 53 | | | Director Nominee | | | n/a | | Viviane Monges (1) | | | 57 | | | Director | | | 2021 | | Julie O’Neill | | | 55 | | | Director | | | 2021 | | Provisionally Appointed

Directors Subject to Shareholder Ratification | | | | | | | | | | | Timothy E. Morris (1) | | | 59 | | | Director | | | 2022 | | Continuing Directors | | | | | | | | | | | Daniel Tassé | | | 61 | | | Chief Executive Officer and Director | | | 2023 | | Michel de Rosen (3) | | | 70 | | | Non-Executive Chairman of the Board of Directors | | | 2022 | | Maïlys Ferrère (2)(3) | | | 58 | | | Director | | | 2023 | | Michael J. Goller (2)(3) | | | 46 | | | Director | | | 2023 | | Daniel Soland (1) | | | 62 | | | Director | | | 2022 | | Director Whose Term Expires Immediately Following Annual General Meeting | | | | | | | | | | | Dr. Torbjörn Bjerke (2)(3) | | | 58 | | | Director | | | 2021 | |

| | | | | | | | | | | Name | | Age | | | Position | | Term Expires | | Nominees for Director | | | | | | | | | | | Daniele Guyot-Caparros (1) (2) | | | 65 | | | Director | | | 2024 | | Ravi M. Rao (3) | | | 55 | | | Director | | | 2024 | | Adora Ndu (1) | | | 42 | | | Director | | | 2024 | | Julie O’Neill (2) (5) | | | 58 | | | Director | | | 2024 | | Continuing Directors | | | | | | | | | | | Michel de Rosen (2) (3) | | | 73 | | | Non-Executive Chairman of the Board | | | | | Daniel Tassé | | | 64 | | | Chief Executive Officer and Director | | | 2026 | | Maïlys Ferrère (3) | | | 61 | | | Director | | | 2026 | | Michael J. Goller (3) (6) | | | 48 | | | Director | | | 2026 | | Timothy E. Morris (1) (4) | | | 62 | | | Director | | | 2025 | | Daniel B. Soland (2) | | | 65 | | | Director | | | 2025 | |

| | (1) | Member of our audit committee.committee (the “Audit Committee”) |

| | (2) | Member of our compensation committee.committee (the “Compensation Committee”) |

| | (3) | Member of our nominating and corporate governance committee.committee (the “Nominating Committee”). |

| (4) | Chair of our Audit Committee |

| (5) | Chair of our Compensation Committee |

| (6) | Chair of our Nominating Committee |

Daniel TasséNominees for Director: has served as Chief Executive Officer since November 2018 and as a member of our board of directors since March 2019. From March 2016 to November 2018, Mr. Tassé served as the Chairman and Chief Executive Officer of Alcresta Therapeutics, Inc., a pediatric-focused rare disease biotechnology company. From January 2008 to April 2015, Mr. Tassé served as the Chairman and Chief Executive Officer of Ikaria, Inc., which develops drugs and devices for critically ill patients. In April 2015, Ikaria was acquired by Mallinckrodt Pharmaceuticals. Mr. Tassé holds a B.Sc. in Biochemistry from Université de Montréal. The board of directors believes that Mr. Tassé’s leadership and extensive experience in the pharmaceutical industry will allow him to drive us to the success of our objectives.

Michel de RosenDaniele Guyot-Caparros has served as a member of our Board of Directors since October 2022. Danièle has thorough experience in the fields of finance and operations. She began her career at PricewaterhouseCoopers (PwC), a multinational professional services and audit firm, as an auditor, also acquiring extensive experience in corporate finance with a focus on the chemical and pharmaceutical industries. In 1992, she joined the financial department of the Rhône-Poulenc-Rorer group, a French chemical and pharmaceutical company (which became Aventis and then Sanofi), within which she held important international responsibilities (CFO R&D worldwide, CFO Europe, Head of the Pharmaceutical Operations plan). She also developed expertise in business development and optimization of product portfolios. In 2008, she became Senior Advisor for Deloitte Conseil in France, a multinational professional services and audit firm, in order to support the development of the pharmaceutical industry and the health sector. To this end, she has assisted with numerous missions with a wide variety of clients (large and medium-sized pharma, biotech/medtech companies, scientific foundations, etc.) with a focus on issues of business transformation, governance and M&A. Danièle has held independent director responsibilities in several biotechs/medtechs. From 2015 to 2017, she was a member of the supervisory board and the audit committee of directors since May 2018 and asDiaxonhit, a publically traded French biotechnology company (which became Eurobio Scientific-listed on Euronext Growth). She chaired the audit committee of Supersonic Imagine, a French biotechnology company, until its takeover by the US Non-ExecutiveHo-logic Chairman of our board of directors since Marchgroup, a U.S. medical technology company, in 2019. Mr. de Rosen also servesFinally, from 2013 to June 2023, she was on the board of directors of FaureciaONXEO, a clinical-stage biotechnology company, (listed on Euronext, OMS Copenhagen and Pharnext. Mr.then Euronext Growth), where she chaired the audit committee and the board from May 2019 to July 2021. Ms. Guyot-Caparros is a graduate of ICN

19

(Institut Commercial de Rosen served as ChairmanNancy) specializing in finance/accounting and Chief Executive Officer of Eutelsat from 2009 until his retirement in November 2017, Chairman and Chief Executive Officer of ViroPharma from 2000 to 2008, and Chairman and Chief Executive Officer of Rhone-Poulenc Santé from 1993 to 1999. Healso has a higher accounting degree. She also held numerous positions at the French Ministries of Finance, Defense, Industry and Telecommunication. Mr. de Rosen holds an M.B.A. from HEC and an M.B.A. from Ecole Nationale d’Administration.independent director certificate issued by IFA-Sciences-Po. The boardBoard of directors believes that Mr. de Rosen’s extensive business experience in the biopharmaceutical industry and over 15 years’ experience in the United States will be instrumental to the success of our objectives.